Paysafe is on a mission to enable businesses and consumers to connect and transact seamlessly through industry-leading capabilities in payment processing, digital wallet, card issuing and online cash solutions. Delivered through an integrated payments platform, their solutions are geared toward mobile-initiated transactions, real-time analytics and the convergence between brick-and-mortar and online payments.

Onboarding new Paysafe customers used to be quite a lengthy process that was being handled by a document upload facility. This process could take a day or longer to complete.

Paysafe needed an automated solution that would enable them to verify customer identities in a matter of seconds — not hours or days — while meeting strict Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance mandates.

Jumio has been Paysafe’s primary identity verification and document verification provider since 2014, and has been helping Paysafe continue to meet its KYC and AML requirements while minimizing the need for time-consuming manual review.

“As soon as I heard about Jumio’s services it became quite obvious what the opportunities for improving our customer experience were,” said Alessandro Bruno-Bossio, Paysafe senior vice president of customer service. “Since then, Jumio has continued to lead in its space and develop its technology. They have also stayed ahead of the curve as regulatory requirements have increased and released other features that have helped us counter friction and customer pain points as part of our compliance procedures.”

In order to meet KYC and AML compliance standards, Paysafe needs to not only verify customer identities but confirm their current residential addresses. These regulations are designed to stop corruption, money laundering and the funding of illegal activities, and they impose an added burden of identity assurance that a customer or user is who they claim to be online.

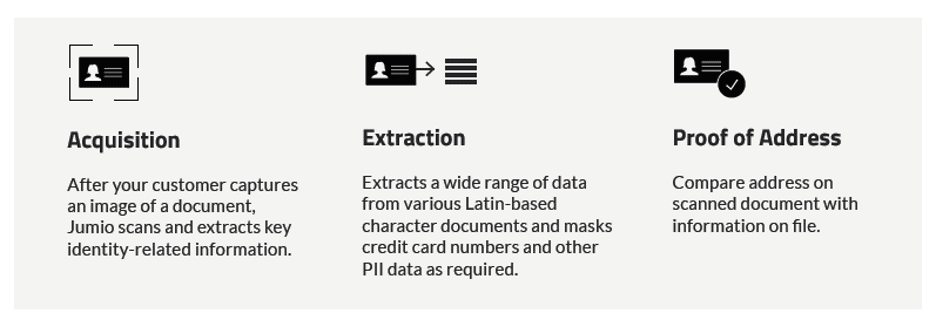

Jumio Document Verification enables customers to verify their address over the internet, rather than in person. Paysafe customers can quickly take a picture of documents such as utility bills, credit card statements, bank statements and Social Security cards using their smartphones, even if the documents are crumpled or creased.

It is, in part, because of Jumio Document Verification that what used to take a day (or more) to complete now takes mere minutes.

“There was definitely an increase in conversions as a result of implementing Jumio, and a big step change for us compared to when we were doing manual reviews,” said Jason Harper, Paysafe vice president of product. “That helped us in a real, tangible way. It was very impactful for onboarding and conversions.”

Read the entire Paysafe case study here.