Online Identity Verification & AML for Financial Services

Streamline the Remote Onboarding Process

Given the rise in branchless challenger banks and an increasing need for large incumbents to offer remote onboarding, online identity verification and eKYC are essential. Jumio’s unique combination of informed AI, computer vision and machine learning enables financial services firms to reliably and securely verify remote users while streamlining the onboarding process.

- Simplify and expedite the identity verification process

- Increase account opening conversions

- Help prevent identity and impersonation fraud

Simplify AML Screening

From banking to fintech, lending to payments, Jumio helps financial services companies screen out bad actors to meet regulatory obligations. Our screening solution checks against sanctions, politically exposed persons (PEPs) and adverse media watchlists — during onboarding and throughout the customer lifecycle.

- Reduce false positives

- Minimize manual reviews

- Harness fully automated and on-demand screening

Solutions Across the Financial Services Ecosystem

Remote Onboarding

Simplify the new account onboarding process while avoiding the time and expense of validating every new customer in person.

Money Transfers and Payments

Provide a more secure digital platform for seamless financial transactions while meeting KYC/AML requirements.

Crowdfunding

Prevent fraud and account takeover in order to safeguard the experience for customers and investors.

High Risk Transactions

Prevent account takeover and safeguard your customers accounts with biometric authentication, which delivers significantly higher levels of digital assurance.

AML/KYC Compliance

Ensure regulatory compliance including Know Your Customer (KYC) and Anti-Money Laundering (AML) in real-time, as if your customer is standing in front of you.

Mortgage Applications

Remove friction from the mortgage application process by authenticating documents online and meeting KYC requirements.

Wealth Management

Identify and onboard more customers quickly, in real time, with nominal to no friction. Protect your customer assets against sophisticated account takeovers with advanced fraud detection and authentication solutions.

How Jumio Benefits Financial Services

Go Branchless with Remote New Account Onboarding

As more and more banking is happening digitally, financial institutions need to find ways to go branchless and accelerate their digital transformation efforts.

- Complete the online identity verification process in seconds.

- Deliver a simple and secure onboarding experience.

- Enable users to create accounts directly from their phone or desktop computer.

Increase Account Opening Conversions

Decrease account origination drop-off rates by up to 40% with a process that is easy on users and tough on fraud.

- Extract and auto-populate customer data from government-issued ID documents into registration forms.

- Instantly populate data into the account opening fields to make it easier and faster to complete applications.

- Verify the validity of ID documents in near real-time to avoid breaking the momentum of the signup process.

Prevent Originations Fraud and Account Takeover

Jumio enables real-time ID and identity verification to enhance your security profile and verify a user is who they say they are.

- Anchor the identity of your online customers with a government-issued ID document and a corroborating selfie.

- Leverage certified liveness detection to ensure the remote user is physically present and not using a spoof (e.g., a picture of a picture or a deepfake video) to circumvent the selfie requirement.

- Secure high-risk transactions (e.g., wire transfers) with biometric authentication, which provides significantly higher levels of identity assurance compared to KBA or simple passwords.

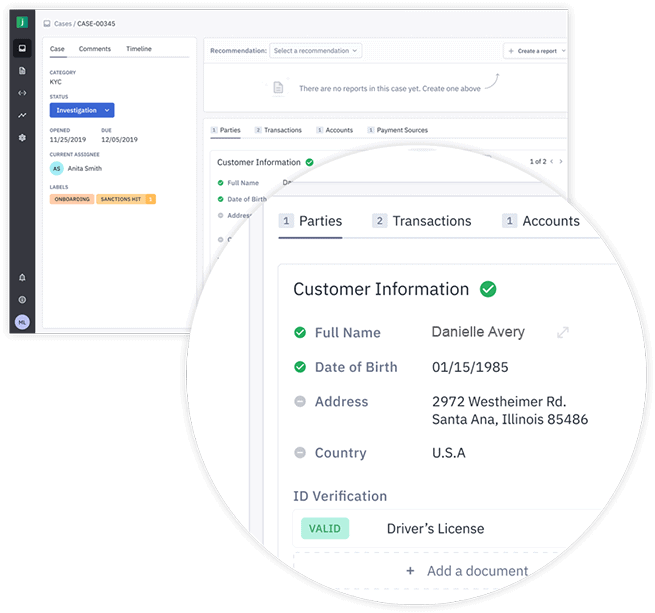

Ensure AML and KYC Requirements

Jumio includes face-based biometrics powered by informed AI to deliver a robust, multi-pronged approach to KYC/AML.

- Quickly confirm the validity of customer identification documents as part of your due diligence processes.

- Automatically screen new customers for sanctions, watchlists, PEPs and adverse media to reduce the threat of money laundering.

- Replace slow, ineffective, and manual KYC processes with more automated solutions that can be embedded within the online account setup and onboarding experience.

- Monitor customers throughout their lifecycle with your company.

Recommended Solutions

Identity Verification

Doc Proof

Anti-money Laundering (AML) Screening

Authentication

Go

Get Started