As we move on from an overview of the marketplace, it’s important to dig a bit deeper into the trends shaping this moment and the immediate future. We are headed into a period of time when regulations may change substantially owing to factors both common and new to the industry of iGaming. Let’s examine some trends for 2024 and how they will impact the iGaming industry.

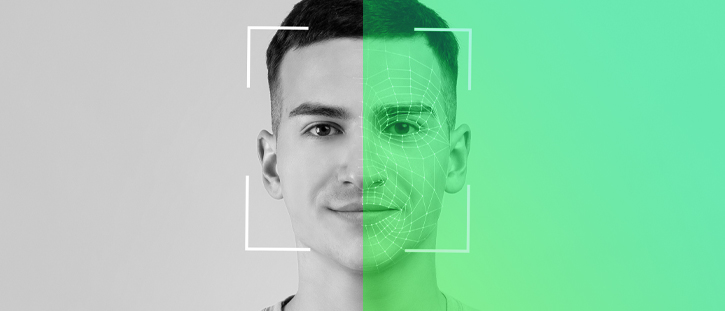

Digital identity is a key trend in 2024. A digital identity is a reusable, digital proof of identity issued by a trusted authority with a known level of assurance. These identities are usually linked to government-issued identification documents (IDs) such as driver’s licenses and passports but are stored digitally. Digital identification is becoming more important as our lives become increasingly lived online.

Digital identity verification has several advantages over the traditional methods such as simple photos of driver’s licenses, passports or Social Security number verification. Digital identities can be protected against unauthorized access and encrypted. Digital identities are convenient and efficient, since users can confirm their identity without needing physical documents. We anticipate this trend will accelerate and have a major impact on the iGaming industry, owing partially to the fact the industry itself has been a relatively early adopter of these measures. As digital identity usage spreads, this may well act as a catalyst for increased digital gambling. As the sign-up process becomes even more streamlined and includes built-in assurances of accuracy, age verification and fraud prevention, growth will likely be the net result.

Age verification is one area where changes continue to be most evident. The governments of numerous countries are increasing scrutiny of online gaming platforms to make sure they do not allow underage players to access them. In the next 12 months, we expect more iGaming platforms to move beyond simply extracting the date of birth from a government-issued ID to implementing robust age verification systems that include biometric data such as facial recognition or fingerprints to verify a user’s age and identity. Platforms may also be required to use real-time monitoring to prevent minors from accessing content that is restricted by age, and also to deter AI-assisted playing.

Money laundering is an important concern for the online gaming industry. But things are changing quickly in the age of AI as the ability to track, analyze and trace transactions in near real-time is becoming more possible by the day. Add to this the rise of the crypto market and serious issues with criminality at a global scale, and the issue of money laundering has risen to become one of the top concerns for iGaming.

Online gambling has been an easy way to launder money since it has historically facilitated a method for criminals (acting as a group) to intentionally win or lose games as a way to transfer money without a paper trail. There are a myriad of ways this has been accomplished, but the basic premise is simple: a criminal uses an online casino as a vehicle to turn ill-gotten gains from one person into legitimate winnings of a cooperative individual, who then returns these “laundered” funds to the criminal in exchange for a fee.

To combat the issue, governments are passing stricter regulations that require online gaming platforms to implement robust anti-money laundering (AML) detection, reporting and deterrence. These regulations place an emphasis on Know Your Customer (KYC), which includes customer due diligence and enhanced due diligence procedures. In more sophisticated systems, AML screening — which screens customers against watchlists for politically exposed persons (PEPs), adverse media and sanctions — runs alongside identity verification to reduce friction during onboarding.

We are seeing a greater focus on AML in 2024, particularly in established markets such as North America, the U.K., Europe and South America. Online gaming platforms must invest in AML screening and ID verification technology that can detect and prevent money-laundering activities, or the threat posed by this single issue may become the headline of many stories of casino shutdowns and/or potential criminal prosecutions.

To protect the privacy of users, governments have begun enacting regulations on data protection. In the EU, the General Data Protection Regulation (GDPR) is an example of legislation that sets strict standards for collection, storage and use of data. This is important because more times than not, when criminality occurs in the identity theft space online, it is as a byproduct of this collection and subsequent negligent storage and/or dissemination of their data.

Account takeover is becoming a major area of concern for many gaming operators. Criminals buy lists of stolen credentials, usually usernames and passwords that resulted from data breaches, and then use credential stuffing to sign in to user’s accounts. Once they sign in, they can transfer funds out of the account or simply use the account’s credits to gamble. Account takeover can also happen as “friendly fraud,” where a minor signs in to a friend’s or relative’s account, for example. For this reason, iGaming platforms are increasingly implementing advanced authentication solutions to ensure the person returning to the platform is the same person who opened the account. In addition to multi-factor authentication and more stringent password requirements, many operators are now using biometric authentication during high-risk transactions such as transferring money out or changing the account password.

Further complicating matters is the Biometric Individual Privacy Act, or BIPA. BIPA is a piece of legislation passed in the state of Illinois in 2008. BIPA bans private companies from surreptitiously collecting biometric data on individuals without prior informed consent and imposes stiff fines on those who do. Several other states, including Texas and Washington have followed suit.

Additionally, 2024 is shaping up to be a big year for changes in data regulation, and numerous jurisdictions including Canada, Mexico and Brazil are considering legislation to curb the collection and mishandling of consumer data. These changes are not restricted to the developed markets. Data protection laws are being enacted worldwide to varying degrees, and we can anticipate serious changes in the way user data is handled and processed, with increased fines and penalties for companies who sell, handle or otherwise are negligent with user data.

This is leading many in the iGaming market to get out ahead of the problem to make their platforms as safe as possible, before cyberthreats emerge, and to ensure their identity verification and authentication solutions adhere to GDPR, BIPA and other privacy standards by collecting informed consent from consumers and properly storing their data.