![10 Tips to Convert More Customers During Account Onboarding [Infographic]](https://www.jumio.com/app/uploads/2020/02/Convert-More-Customers-Infographic-Social.png)

The digital onboarding journey is in need of a serious shake-up.

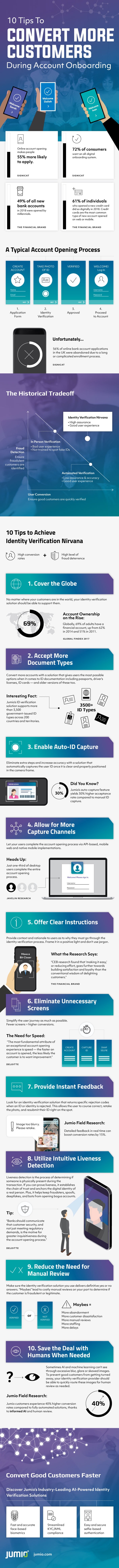

While 72% of consumers want an all-digital onboarding experience, they’re clearly not happy with the current state of affairs — 56% of online bank account applications in the UK were abandoned due to a long or complicated enrollment process.

There are a number of reasons why consumers don’t complete the onboarding process, and oftentimes it’s because of too much friction during the identity verification part of the process.

In the past there have been historical trade-offs when balancing fraud detection and user conversion. Spend too much time on KYC with undue friction and you’re bound to see a drop in conversions, but an overly simple, friction-free onboarding process makes it too easy for fraudulent customers to infiltrate your ecosystem.

Detecting fraud while also offering a convenient digital onboarding experience to your customers doesn’t have to be an either/or situation.

Our new infographic shows you how to achieve identity verification nirvana and provides 10 practical tips for improving the onboarding process. Want to learn more? Watch our on-demand webinar, 10 Ways to Dramatically Cut Abandonment Rates During Account Onboarding.