Jumio Case Study – Webull

Webull Bolsters Trust, Safety and Financial Inclusion with Jumio

Jumio’s AI-powered eKYC technology helps digital investment platform scale at a global level

Webull is a leading digital investment platform built on next-generation global infrastructure. Founded in 2016, Webull Corporation serves tens of millions of users from over 180 countries, providing retail investors 24/7 access to financial markets around the world. Users can put investment strategies to work by trading global stocks, ETFs, options, and fractional shares, through Webull’s trading platform, which is currently available in the United States, Hong Kong, Singapore and Australia.

Incorporated in 2021, Webull Securities (Singapore) Pte. Ltd. is regulated by the Monetary Authority of Singapore (MAS) and holds a Capital Markets Services (CMS) Licence under the Securities and Futures Act 2001. Leveraging Webull’s wide global presence, Webull Singapore aims to create an efficient, low-cost and easy-to-use global asset distribution platform for the APAC region.

The MAS and other licensing authorities require banks and financial service providers to implement electronic Know Your Customer (eKYC) processes if they want to onboard customers online. As such, Webull needed a vendor familiar with global regulatory standards that would help scale eKYC compliance in line with their expanding global business operations.

How Jumio Helps

After evaluating several vendors, Webull chose Jumio in 2022, first in Singapore but later expanding to a global model that also supports business in Australia and the U.K. Jumio will also support Webull’s upcoming expansion into Indonesia.

Jumio offers the most comprehensive eKYC solution on the market, accepting and reliably verifying multiple types of government-issued IDs including passports, driving licenses and ID cards. Jumio supports more than 5,000 ID subtypes around the globe and has processed more than 1 billion transactions spanning more than 200 countries and territories. Jumio’s extensive global presence ensures the ability to provide timely and localized support to business clients worldwide, especially during cross-border expansion efforts.

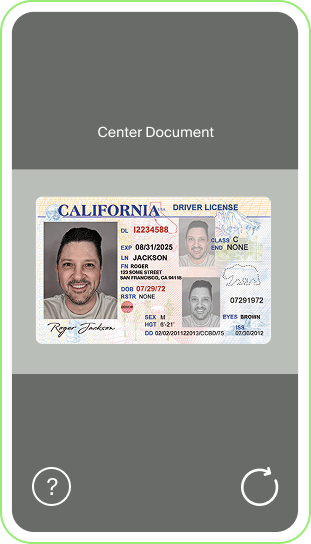

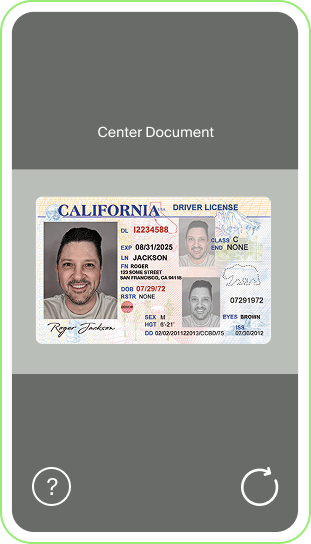

Jumio Identity Verification solutions leverage the power of biometrics, AI and the latest technologies to quickly and effectively verify the identities of new Webull customers. During onboarding, customers take a picture of their government-issued ID and a corroborating selfie. Jumio determines whether the ID document is authentic and verifies that the person pictured in the selfie matches the picture on the ID, providing an accurate verification decision in seconds and ensuring a user-friendly experience.

Jumio’s pioneering eKYC solutions have established up-to-date digital standards, seamlessly verifying identities and preventing fraud.”

“Jumio understands the regulatory requirements and fraud landscape well and updates its eKYC solution along with the fast-changing fraud landscape,” Teo said. “Working with a strong vendor like Jumio enables us to focus on strengthening our core business and delivering more value to our clients.”

Webull is dedicated to safeguarding its clients and their assets by consistently enhancing its product offerings, delivering world-class financial solutions to its valued clients. Jumio established a dedicated team to facilitate cross-border communication and worked closely with Webull throughout the project lifecycle, understanding and tailoring the solution to meet the unique needs of various markets.

How Jumio Identity Verification Works

Try Our Demo App

How Jumio Identity Verification Works

ID Check

Is the identity document (ID) authentic and valid?

Selfie

Jumio's selfie + liveness check process verifies: Is the person holding the ID the same person shown in the ID photo? Are they physically present during the transaction? Is this a real person, not a spoof?

Decision

For a risk-based decision, Jumio calculates the fraud risk and approves or rejects the identity transaction in seconds based on your predefined risk tolerances.